|

Happy New Year 2023! Hope you had a great Christmas/holiday season. Let's dive right into this month's tips.

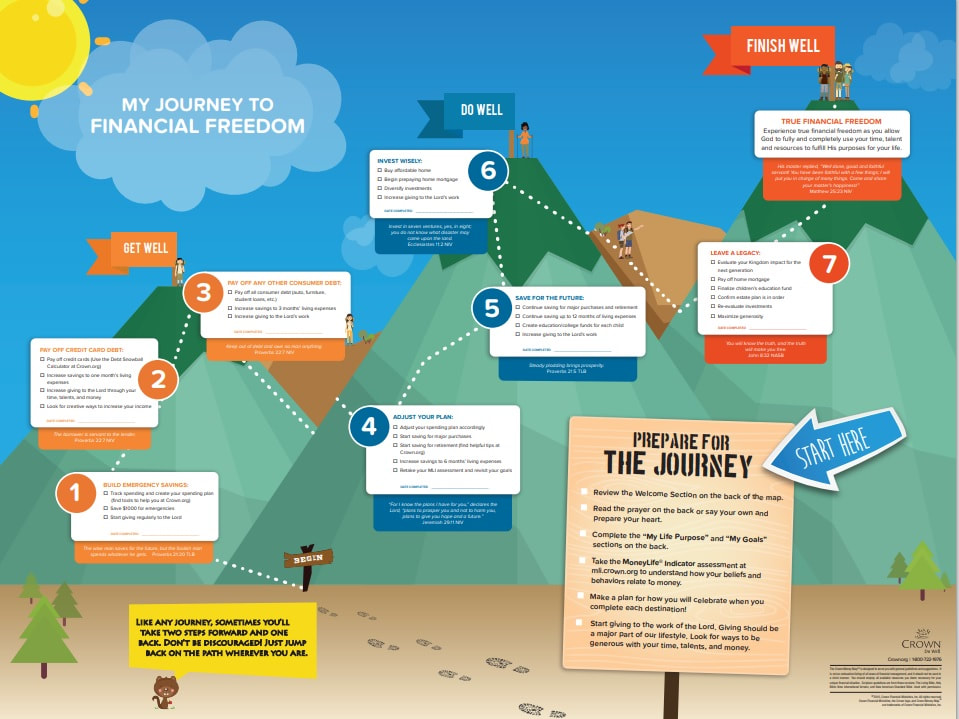

1. I'll start with a new tax law - Underused Housing Tax - that came into effect on January 1, 2022. Here's the description from CRA (Canada Revenue Agency) page: "The Underused Housing Tax is an annual 1% tax on the ownership of vacant or underused housing in Canada that took effect on January 1, 2022. The tax usually applies to non-resident, non-Canadian owners. In some situations, however, it also applies to Canadian owners." If you are a Canadian resident or citizen and your corporation owns a residential property, check with your corporate tax accountant to see if there is any filing to be done. Here is CRA's page if you want to read more about it: Underused Housing Tax. 2. This is the time when many make resolutions; they want to have a better version of themselves. If I may suggest, think about what you accomplished last year and set one wish list for 2023. Every quarter I'll check-in with you (via my newsletter) to see how your goal is going. Feel free to update me. :) If your wish list includes taking care of your personal finance (cash flow), you may be interested in the Crown Money Map from Crown Financial Ministries. See image below. It lays out what you should do with your finances. - Have an emergency fund, because emergencies will happen and you want to be prepared financially. - Pay off debts (unsecured and secured). - Save for future goals (short, medium, long) such as vacation, purchasing a home, and retirement fund. - Invest. These may happen simultaneously. Oh, and since tax season is coming up soon, you should probably start gathering receipts and other tax-related papers. :) 3. Tax season has not started yet, but I have been receiving inquiries from individuals who would like to get a head start on their taxes. Here are some examples of questions I received. - What business expenses can I deduct? - How much should I set aside to pay for taxes? - How much should I put into my RRSP? - Is RRSP (Registered Retirement Savings Plan) better for me? Or TFSA (Tax-Free Savings Account)? You may be bombarded with RRSP messages soon. Before contemplating the usual RRSP or TFSA, if you are an employee, check if you have maximized your company's pension or your company's offer for matching your pension contribution. For example, your company allows you to contribute 6% to a locked-in company pension and will match your contribution by putting in another 6% into your account, this means you have ONE HUNDRED PERCENT (100%) return on your investment, GUARANTEED! No investment advisor can guarantee you a 100% return consistently EVERY TIME. So, check your company pension and ensure you have taken advantage of it. Then, you can decide if RRSP or TFSA is better for you. Generally, if you earn less than $45,000/year, TFSA is better for you. However, each person's situation is different and you should not make decisions only from a tax point of view. Anyhow, in case you're interested, here is an RRSP calculator from TurboTax, which you can use to calculate how much you need to put into your RRSP to minimize your tax: TurboTax RRSP Calculator. That's all for January. See you in February. To get monthly Tax and Money Tips delivered into your mailbox, send an email to [email protected] with subject "Subscribe." Visit my blog page or follow me on LinkedIn, IG, FB, Twitter for more money and tax tips.

0 Comments

|

AuthorCommitted to help clients to be literate about their personal financial situations, to reduce their money-related stress, and to help them achieve their financial goals. Archives

March 2025

Categories |

RSS Feed

RSS Feed